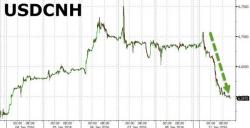

Yuantervention Extreme - Offshore Yuan Explodes 850 Pips Higher, Biggest Jump Ever

While some central banks prefer to stealthily 'manage' their markets, a bid here, a stick-save there, today's epic intervention, short-squeeze, carry-trade-carnage in Offshore Yuan is the most visible hand yet in the new normal world of central planning. USDCNH is now down over 850 pips on the day - a record 1.25% strengthening in the offshore Yuan...

CNH is now 15 handles stronger from the "halt" spike lows last week...

This is the biggest single-day drop in USDCNH (strengthening in Offshore Yuan) since records began...