The Game Of Chicken Between The Fed & The PBOC Escalates

Submitted by Ben Hunt via Salient Partners' Epsilon Theory blog,

Submitted by Ben Hunt via Salient Partners' Epsilon Theory blog,

Earlier today, Art Cashin summarized most (very desperate) traders' thoughts when he said that as a result of today's market crash, "the Fed will try anything" to prop up the wealth effect it had so carefully engineered with seven years of central planning in the aftermath of the financial crisis. Perhaps the only question left is "where is the put", or where on the S&P 500 is the Fed's breaking point beyond which Yellen will have no choice but to make a statement, or take action, in support of the market.

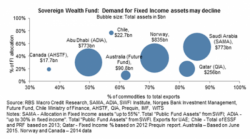

We’ve spent quite a bit of time documenting Norway’s precarious balancing act in the face of slumping crude prices.

On the one hand, falling crude puts pressure on the krone which essentially allows the Norges Bank to compete in the regional currency wars without resorting to the same type of deeply negative rates as the ECB, the Riksbank, the Nationalbank, and the SNB. In short, a falling krone preserves export competitiveness in a world gone Keynesian crazy.

One year ago, when the Fed released its 2009 transcript, we learned that after a terrible 2008, the Fed's sense of humor gradually returned and instances of the word "laughter" in declassified Fed transcripts rebounded in 2009.

As a reminder, the Fed's sense of humor as determined by recorded incidences of "laughter" at FOMC meetings hit their highest level on record in July 2007, which coincides exactly with the moment when the housing bubble finally burst (remember: they weren’t laughing at you, they were laughing with you). The laughter died down quickly after that.

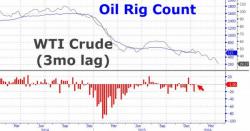

While gas rigs fell 13 last week, oil rigs dropped just 1 to 515. Crude's initial reaction was to extend losses...

Rig count continues to track a lagged crude price perfectly...