Exclusive: Dallas Fed Quietly Suspends Energy Mark-To-Market On Default Contagion Fears

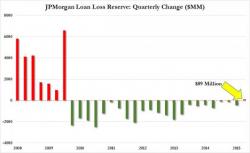

Earlier this week, before first JPM and then Wells Fargo revealed that not all is well when it comes to bank energy loan exposure, a small Tulsa-based lender, BOK Financial, said that its fourth-quarter earnings would miss analysts’ expectations because its loan-loss provisions would be higher than expected as a result of a single unidentified energy-industry borrower. This is what the bank said: