Ron Paul Warns: "Watch The Petrodollar"

Submitted by Nick Giambruno via InternationalMan.com,

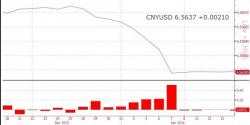

The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better. - Ron Paul

Ron Paul is calling for the end of the petrodollar system. This system is one of the main reasons the U.S. dollar is the world’s premier reserve currency.