"In Jeopardy" The Bull Market Is Breaking Bad-der

Via Dana Lyons' Tumblr,

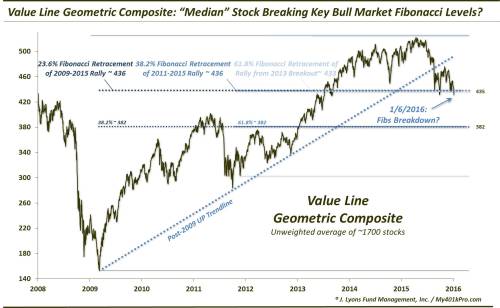

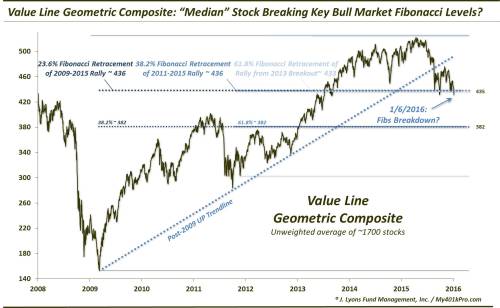

Today saw a slew of significant levels related to the post-2009 bull market break on several key stock indices.

Via Dana Lyons' Tumblr,

Today saw a slew of significant levels related to the post-2009 bull market break on several key stock indices.

Two words - "policy" and "error"

Gold up 3%, Long bonds up 2%, Stocks down 5% since the Fed hiked rates: This was not supposed to happen!

And money markets are not buying what The Fed is selling.

What rate hike? The market is starting to whisper about an imminent rate cut.

Bitcoin Blockchain technology has progressed from a little known nerd interest, to media darling to Mt. Gox/Silk Road infamy, to the realization that modern finance and the burgeoning Internet of Things as well as large swaths of everyday personal and corporate life will likely be based on it for the foreseeable future. The last year has witnessed a sea change in understanding of this new paradigm.

The much-watched four-week average of initial jobless claims rose to 277k, accelerating to the highest levels since early July 2015. This "trend shift" began as rate-hike odds increased in October... just as we saw the trend shift after QE3 ended...

Continuing claims rose once again hovering at its highest in 4 months.

A little over two months ago, when official PBOC data revealed that not only had Chinese reserve outflow slowed down, but actually posted an uptick in October, we warned that "Capital Is Still Flowing Out Of China, Here's How Beijing Is Hiding It", in which we explained that in taking a page from the western bankers' playbook, the Chinese central bank had shifted to less "traceable" forms of currency manipulation, namely via "forwards". To wit: