A "Witch's Brew" Bubbling In Bond ETFs

Via The Financial Repression Authority,

Via The Financial Repression Authority,

Prepare to be taxed.

Behind the veneer of “all is well” being promoted by both world Governments and the Mainstream Media, the political elite have begun implementing legislation that will permit them to freeze accounts and use your savings to prop up insolvent banks.

This is not conspiracy theory or some kind of doom and gloom. It’s basic fact.

Authored by Carmen Reinhart, originally posted at Project Syndicate,

On Christmas Day, 2015, we told our readers the fascinating tale about the Turkish-Iranian gold smuggling ring - perhaps the biggest and most brazen in history, one which lasted for years, which saw billions in gold transported out of Turkey and into Iran to allow Tehran to circumvent the western financial sanctions using gold as a medium for bater, and which was all made possible thanks to the tiny Emirate of Dubai.

What made this particular instance of gold smuggling especially memorable is that it reached to the very political top in both Turkey, and Iran, and Dubai.

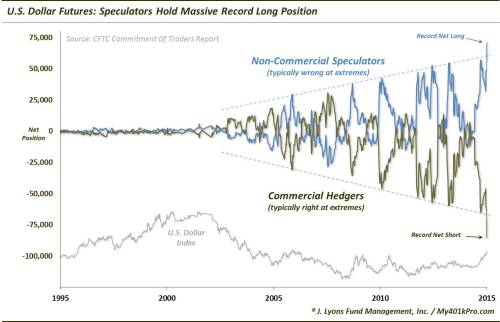

Via Dana Lyons' Tumblr,

As we wrap up 2015, we again pause to reflect on the noteworthy events that took place across the financial markets this year.