Canadian Dollar Crashes To 12-Year Low After Collapse In Consumer Prices

Not since December 2013 have Canadian Consumer Prices dropped by such a large amount. November CPI dropped 0.3% MoM, dramatically worse than expected to the largest drop since Dec 2013. The largest YoY drop in Canadian CPI, amid a surge in inventories relative to a collapsee in wholesale sales sent the loonie crashing above 1.4000 for the first time since August 2003.

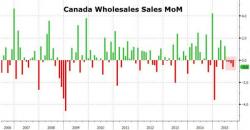

Candian CPI tumbles and Wholesale Sales plunges...

Which send USDCAD to 12 year lows...

Charts: Bloomberg