The Market Has Spoken: The Fed Made A Policy Mistake And "Quantitative Failure" Looms - What Comes Next

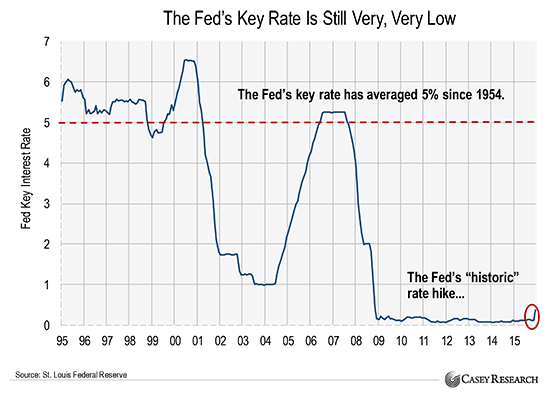

Now that the Fed's rate hike is in the history books and Yellen is eager to demonstrate that the Fed is confident enough in the US economy by unleashing the first tightening cycle in nearly a decade, market participants are dramatically shifting their attention, from the rate hike as a bullish key catalyst in the "renormalization" timeline ("buy stocks" because the Fed wouldn't risk recession if it wasn't confident in the economy), to the actual consequences of the Fed's dramatically changed reaction function, which as we explained previously, was far more hawkish than the market initially