"I Know Of No One Who Predicted This": Russian Oil Production Hits Record As Saudi Gambit Fails

In late October, we noted that for the second time this year, Russia overtook Saudi Arabia as the biggest exporter of crude to China.

In late October, we noted that for the second time this year, Russia overtook Saudi Arabia as the biggest exporter of crude to China.

As a result of the Fed's balance sheet expanding to $4.5 trillion over the past 7 years, the most direct consequence has been the increase in excess reserves held at various banks to just over $2.5 trillion. This, as we have shown before using the Fed's H.8 data, means that cash held by various commercial banks has risen proportionately, and as shown in the chart below, there has been a direct correlation between the amount of excess reserves in the system (shown by the black line) and bank cash holdings.

Submitted by Charles Hugh-Smith via OfTwoMinds blog,

The injustice of central-bank enforced neofeudalism cannot be suppressed like interest rates.

When it comes to central bankers gone “full Krugman” (as it were) you’d be hard pressed to find someone more Keynesian crazy than BoJ governor Haruhiko Kuroda.

Kuroda - who earlier this year likened himself to Peter Pan on the way to explaining that it’s possible to conduct unconventional monetary policy in perpetuity as long as market participants continue to “believe” - has not only managed to suck up the entirety of gross JGB issuance, he’s also succeeded in cornering the market for Japanese ETFs.

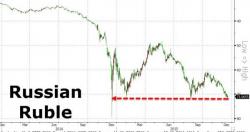

OPEC blowback continues to ripple around the world. With Russia's Ruble pushing back towards record lows against the USD, and Kazakhstan's Tenge having tumbled to record lows, the writing was on the wall for Azerbaijan. As Bloomberg reports, the third-biggest oil producer in the former Soviet Union moved to a free float on Monday and the manat crashed almost 50% instantly to its weakest on record with the second devaluation this year.

First the Russian Ruble...

Then Kazakhstan's Tenge...