FX Weekly Preview: Looking For A Rise In Vol As The Fed Finally Makes Their Move - So We Can All Move On

Submitted by Rajan Dhall MSTA and Shant Movsesian from fxdailyterminal.com

Submitted by Rajan Dhall MSTA and Shant Movsesian from fxdailyterminal.com

The gradual acceptance of digital currencies, with major exchanges about to launch bitcoin futures trading, may prompt some oil producing nations to ditch the US dollar in crude trade in favor of cryptocurrencies, an oil analyst says.

As RT reports, Russia, Iran and Venezuela have more than one thing in common.

All three are major oil producing nations dependent on the dollar since the global crude market is traditionally dominated by contracts denominated in US currency.

MODERN JUGGERNAUTS LIKE APPLE DON’T EVEN COME CLOSE

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Courtesy of: Visual Capitalist

Before speculative bubbles could form around Dotcom companies (late-1990s) or housing prices (mid-2000s), Visual Capitalist's Jeff Desjardins notes that some of the first financial bubbles formed from the prospect of trading with faraway lands.

Looking back, it’s pretty easy to see why.

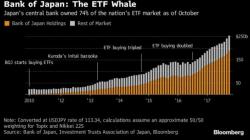

A few months ago, we noted that the Bank of Japan had decided to throw every textbook out of the window and crank their plunge-protection to '11'after reports surfaced that they owned a staggering 75% of Japan's ETFs.

The BOJ first started their buying spree in December 2010 - when they held no ETFs at all - and have since accumulated some $150 billion in aggregate holdings. The buying was all as part of unprecedented "economic stimulus" which has undoubtedly contributed to the Nikkei 225 Stock Average surging roughly 125% since December 2010.

Once upon a time, Wall Street analysts had just two things to worry about: interest rate risk and corporate profits - virtually everything else was derived from these. Unfortuantely, we now live in the new normal, where central banks step in every time there is even a whiff of an imminent market correction (as BofA explained last week), and the result is that nobody know what is and what isn't priced into the market any more, simply because the market in the conventional sense of a future discounting mechanism no longer exists (as Citi explained earlier this summer).