Hartnett: Every Time Chinese Yields Hit 4%, A Crash Happens

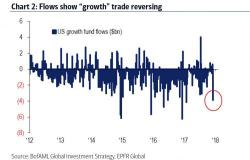

In his latest flow show report, BofA's Michael Hartnett finds that while inflows into markets in the past week continued, with $3.1bn going into stocks - of which $13.7bn went into ETFs, and $10.6bn was redeemed from active managers, $1.2bn into bond and $0.3bn into gold (unfortunately EPFR doesn't track inflows into bitcoin yet), although he noticed something peculiar: the “yield” trade appears to be fading, with the smallest IG inflows in 50 weeks ($1.4bn), while the revulsion to junk continued after the 6th consecutive week of HY outflows.