The Spurious Math Of A Tax-Cut Rally

Authored by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

Authored by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

Despite all the risk/margin worries, and volatility fearmongering, and fraud allegations, Bloomberg reports that, according to a person familiar, Goldman Sachs plans to clear bitcoin futures contracts when they go live next week.

“Given that this is a new product, as expected we are evaluating the specifications and risk attributes for the bitcoin futures contracts as part of our standard due diligence process,” Tiffany Galvin, a

spokeswoman for the bank, said in an emailed statement.

Artist's impression of what Bitcoin did today...

Today was all about Bitcoin - no matter what kind of investor you are...

Via The Daily Bell

In case of emergency, you should always have a solid chunk of cash on hand. These days, that isn’t much riskier than keeping your money in a bank.

There are stories of banks and governments suspending accounts for no legitimate reason. Furthermore, the interest rates at banks hardly give you much incentive to store your money there.

But as with anything that gives individuals more control over their lives, the government doesn’t like it. They want the ultimate control to cut you off from your economic power.

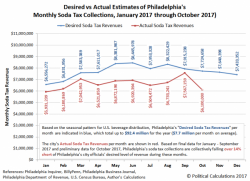

Via Political Calculations blog,