Russia Plans First-Ever Sale Of Yuan Bonds

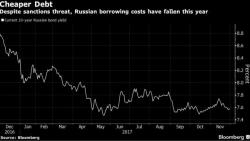

As Russia braces for further sanctions from Washington D.C. over their alleged role in "meddling" in the 2016 U.S. election, they are reportedly prepping a $1 billion yuan-denominated bond issuance in an effort to preemptively diversify financing risks away from the West. According to Bloomberg, the sale will total 6 billion yuan and could come as early as next week.