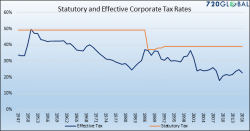

Corporate Tax Cuts: "The Seen & The Unseen"

Authored by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

Authored by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

Submitted by BullionStar.com

A popular phrase in segments of the mainstream financial media is that “You Can’t Eat Gold”. We don’t know who first uttered this comment, but it was more than likely a talking-head or Wall Street analyst on CNBC or Bloomberg.

The disparaging claim seems to be based on concluding that in a financial or monetary crisis, if you own gold, that “You Can’t Eat It”. And so, according to the logic of whoever came up with the phrase, this would make gold useless during a financial crisis.

President Trump has made it widely known that he will not tolerate sanctuary cities like Baltimore, Chicago, Los Angeles, and New York. Since taking office, he has threatened to slash federal funding to cities who do not comply with federal immigrations laws, along with ICE agents circumnavigating local authorities in a nationwide federal operation to arrest undocumented immigrants.

Authored by A. Gary Shilling via Bloomberg.com,

Less regulation is one campaign promise made by the president that is coming true...

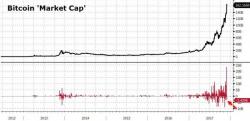

While all eyes were told to focus on the cryptocurrency chaos over here... the widely-owned 'no-brainers' FANG stocks suffered total losses that were almost 20 times larger than the 'losers' in Bitcoin...

At the end of the day - amid all the turmoil - Bitcoin ended the day down over $3 billion in market cap...

However, FANG stocks suffered their biggest market cap loss ever - losing almost $60 billion today...