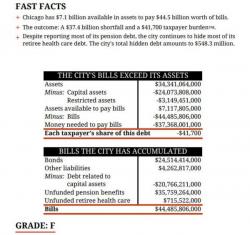

Chicago Gets An 'F' On New Fiscal Report Card As Bonds Continue To Hover Around All-Time Highs

As Illinois muni debt continues to hover around all-time highs, the number of watchdog groups offering warnings about Chicago's deteriorating finances continues to grow. The latest such warning comes from Truth In Accounting which provided the Windy City an 'F' on their latest fiscal report card citing a staggering debt burden that amounts to $41,700 per Chicago resident. To put that figure in perspective, the median household income in Chicago is roughly $48,500.