Chinese Stock Rout Continues Despite Government Ban On Selling Shares

After a brief respite rally at the open on the heels of reports that some funds were banned from large-scale stock-selling, prices for Chinese stocks are tumbling once again ...

As QQ.com reports, some publicly offered funds received a notice that restricted them from selling stocks on a large scale.

The report also notes that funds were banned from selling more shares than they bought on the day.

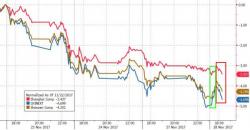

For now, bond prices are steady but the Yuan is weaker.