The Economic Fallacies Of Black Friday: 2017 Edition

Authored by Nullus Maximus via The Zeroth Position blog,

Today, shoppers across America will participate in the largest shopping day of the year: Black Friday.

Authored by Nullus Maximus via The Zeroth Position blog,

Today, shoppers across America will participate in the largest shopping day of the year: Black Friday.

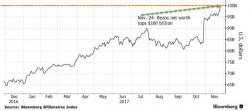

$100,000,000,000....

That is the net worth of Amazon founder (and Washington Post owner) Jeff Bezos after Amazon's shares surged today on optimism over Black Friday.

As Bloomberg reports, the $100 billion milestone makes Bezos, 53, the first billionaire to build a 12-figure net worth since 1999, when Microsoft Corp. co-founder Bill Gates hit the mark.

It’s Black Friday, and in keeping with the Holiday weekend tradition, media commentator Mark Dice traveled to Wal-Marts and other stores to document the “zombie apocalypse” of half-awake consumers hell-bent on elbowing past their peers so they can be sure to get the best deals on electronics, books, video games, clothes and any number of other popular holiday gift items. Of course, as Dice points out, many of the same deals can also be found on a little website called Amazon.com without the hassle of pushing through crowds.

Authored by Stephen Moore op-ed via The Wall Street Journal,

The wealthy have tucked billions into private nonprofits... where the IRS can’t touch it.

It has been an odd year for retail: with an estimated 6,000 store closures, and 65,000 fewer retail jobs than at the start of the year, many have said shorting retail, and especially malls, is the next "big short" trade. Indeed, one look at the performance of the mall heavy CMBX 6 BBB- tranche confirms that the bottom has fallen out of the legacy "bricks and mortar" space.