Brexit Budget – Grim Outlook As UK Economy Downgraded

Brexit budget - Grim outlook as UK economic forecasts downgrade

Brexit budget - Grim outlook as UK economic forecasts downgrade

Nothing can keep the BTFD spirit at bay in Europe this Thanksgiving morning.

In an October 2017 interview, Jamie Dimon famously lambasted Bitcoin as a “fraud” and the people who bought it as “stupid” which, temporarily, halted the ascent in the Bitcoin price. It also led to much heated debate in the mainstream media and much anger across the crypto community. In a just as incendiary follow up, Dimon sat down for another interview, this time as “The Economic Club of Chicago”.

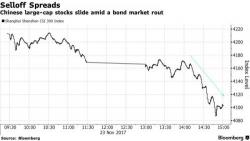

The euphoria from the year-end melt up in Europe and the US failed to inspire Chinese traders, and overnight China markets suffered sharp losses, with the Shanghai Composite plunging 2.3%, its biggest one day drop since June 2016, over growing fears that the local bond rout is getting out of control. Both the tech-heavy Chinext and the blue chip CSI 300 Index dropped over 3%, as the sharp selloff accelerated in the last hour, as Beijing's "national team" plunge protection buyers failing to make an appearance. There were sixteen decliners for every one advancing share.

Yet another UK trader is being punished by overzealous regulators for an accomplishment that should instead have earned him accolades: Outsmarting the machines.

In a case that echoes some of the circumstances surrounding the scapegoating of former UK-based trader Nav Sarao, former Bank of America Merrill Lynch bond trader Paul Walter has been fined 60,000 pounds by the FCA for a practice that regulators call ‘algo baiting’.