The Five Biggest Tests For China's Next Central Bank Governor

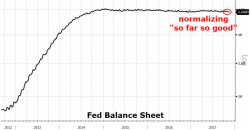

Zhou Xiaochuan’s long reign as PBoC Governor is drawing to a close. He signaled his impending retirement last month and will be seventy years old In January 2018. Zhou has headed up China’s central bank from the early days of China’s “growth miracle” in 2002 and successfully – thanks to massive credit creation - steered China’s economy through the 2008 crisis.

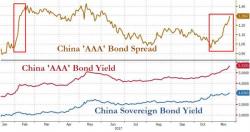

Since then, he’s kept China’s horrendous credit bubble on the rails, while warning of the risk of a “Minsky moment” at the recent Party Congress.