The 'Junkie' Market Is Back

Via Dana Lyons' Tumblr,

The past few days have seen a reversal from substantial net New lows to substantial net New highs – a condition that has preceded poor performance in the past.

Via Dana Lyons' Tumblr,

The past few days have seen a reversal from substantial net New lows to substantial net New highs – a condition that has preceded poor performance in the past.

It's not easy being "the world's most bearish hedge fund", a description we first conceived nearly three years ago, and one look at Horseman Capital's returns over the past three years confirms it: after generating market-beating returns for much of its existence, things went bad in 2015, and much worse in 2016...

... when the Fund had a record net short equity position of over -100%, just as the market ripped higher after the Trump election.

Authored by Brian McNicoll via The Daily Caller,

Jeff Bezos spends a lot of time directing the newspaper he owns, The Washington Post, to criticize President Donald Trump in every way imaginable. But for some reason, the federal government cannot stop giving Amazon — the retail empire Bezos also owns — a slew of taxpayer-subsidized subsidies. Now, Congress is considering a new federal purchasing plan that could result in Amazon’s most lucrative government handout yet.

Authored by Raul Ilargi Meijer via The Automatic Earth blog,

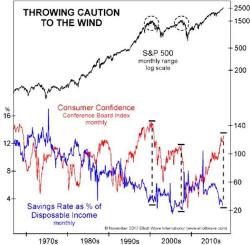

John Rubino recently posted a graph from Bob Prechter’s Elliot Wave that points to some ominous signs. It depicts the S&P 500, combined with consumer confidence and savings rate. As the accompanying video at Elliott Wave, What “Too Confident to Save” Means for Stocks, shows, when the gap between high confidence and low savings is at its widest, a market crash -often- follows.

Authored by James Stack via InvesTech.com,

From public confidence to bullish sentiment to the normally mundane employment data, the U.S. economy and stock market are reaching historic levels not seen in decades. Last month, consumer confidence hit its highest level since December 2000. The percentage of bullish investment advisors recently touched lofty levels that were last reached in January 1987. And this month, the U.S. Department of Labor announced that job layoffs dropped to a 44-year low!