The U.S. Is Crushing Its Clean Energy Forecasts

Paris, schmarish...

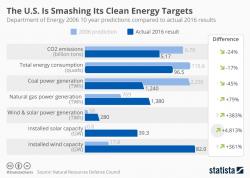

In a February 2007 report, the United States Department of Energy made thirty-year predictions for the country's energy usage and production. As Statista's infographic below shows, using data from the non-profit international environmental pressure group Natural Resources Defense Council, these forecasts have so far been smashed.

You will find more statistics at Statista

Martin Armstrong details that actual CO2 emissions in 2016 have undercut the 2006 predictions by 24 percent.