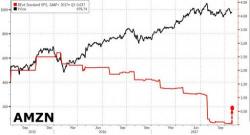

Amazon Soars Above $1,000 After Smashing Expectations

Amazon has done it again, and following a lukewarm second quarter and with Goldman warning not to get too excited going into earnings, Amazon is back to its short-crushing ways, reporting both revenues and EPS which blew away expectations. In Q3, Amazon reported EPS of 52 cents, unchanged from a year ago (due to fudging the company's tax rate) and beating consensus estimates of 4 cents, on net sales of $43.7 billion, also well above the $42.19 billion consensus estimate, entirely due to the contribution of AWS. It was also above the high end of the company's own range, which topped out at