Ray Dalio Explains What Is "The Most Important Economic, Political And Social Issue Of Our Time"

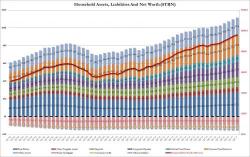

Every quarter, the Fed's Flow of Funds report discloses - among many other things - the total U.S. household net worth, and every quarter for the past two years this number has steadily gone up, hitting fresh all time highs with every new release, most recently $96.2 trillion, to widespread cheers from both the financial press and the public, as well as the administration.