The Dollar Funding Shortage: It Never Went Away And It's Starting To Get Worse Again

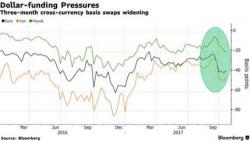

Very quietly, in the last few weeks, cross currency basis swaps (CCBS) related to the dollar have reversed their rise and started moving deeper into negative territory… again. This might not be of much interest to buyers of global equity markets at this point, but it is signalling ominous signs of growing funding stress in the financial “plumbing”.