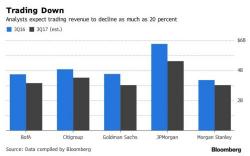

JPMorgan FICC Revenues Plunge 27%, "Low Volatility" Blamed

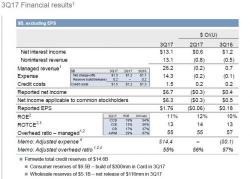

Launching Q3 earnings season, moments ago JPM reported third quarter Net Income of $6.7 billion and EPS of $1.76, beating expectations $1.67 and 18 cents, or 7% higher than a year ago, on "managed" revenue of $26.2 BN, beating consensus expectations of $25.7 BN, up 3% from the $25.5BN in Q3 2016 revenue .

JPM reported average core loans up 7% Y/Y and 2% Q/Q, with net interest income up $1.2Bn Y/Y to $12.5bn, “primarily driven by the net impact of rising rates and loan growth" even as average NIM missed.