Small Cap Stocks Surge To 'Most Overbought' In 20 Years, Bonds Shrug

The largest secession movement since Brexit and the biggest mass shooting in American history... buy stocks!!

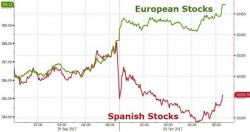

Spain felt the pain...

The largest secession movement since Brexit and the biggest mass shooting in American history... buy stocks!!

Spain felt the pain...

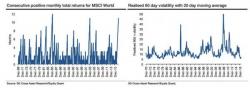

Is it QE or is it earnings?

Authored by Anthony Saunders via Snake Hole Lounge blog,

The Federal Reserve was created by an act of Congress in 1913 and a stroke of the pen by President Woodrow Wilson. And the purchasing power of US consumers has never been the same.

Enter Bitcoin, the worldwide cryptocurrency and digital payment system. Currently, one Bitcoin equals $4,423.

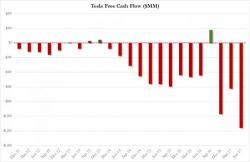

Last month we noted that Tesla really outdid itself in 2Q 2017 by posting a record cash burn of $1.2 billion, or roughly $13 million every single day. Per the chart below, Tesla's Q2 cash burn was just a continuation of the company's money-losing trend that goes back at least 6 years and seems to be getting worse with each passing quarter.

But Tesla isn't alone in burning cash on "EV's" as pretty much every electric vehicle offered to customers loses money on a per unit basis.

Authored by Christoph Gisiger and Mark Dittli via Finanz Und Wirtschaft,

Howard Marks, Co-Chairman of the US investment firm Oaktree Capital warns that valuations in the financial markets are uncomfortably high and that investors are acting too complacent.