Here Are The Two Things Investors Would Find "Most And Least Surprising" In 12 Months

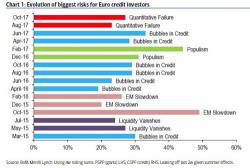

For the second consecutive month, BofA's credit clients responded that there is one thing they find to be the biggest market risk: "quantitative failure", which is also a euphemism for central banks losing control of the bubble they have been inflating for the past 9 years. It's a relatively novel fear, replacing "bubbles in credit" (i.e., not the deflation but inflation part) and "populism" in recent months, although we have a sense that populism may be right back up there very soon.