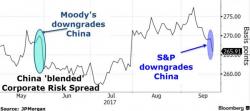

Bond Market Bulls Embrace China Debt Downgrade

It appears credit ratings agencies simply get no respect...

It appears credit ratings agencies simply get no respect...

Authored by Doug Kass via RealInvestmentAdvice.com,

* In a paperless and cloudy world, are investors and citizens as safe as the markets assume we are? –Kass Diary

Another provocative missile launched by North Korea and another apparent terrorist attack in London, England, are, once again, overnight and early-morning features of our reality as investors and as citizens.

Two weeks ago, one of our favorite derivatives strategists, BofA Barnaby Martin wrote something we have said for years: "QE has been the most effective way for CBs to 'sell vol'", arguing that accommodative monetary policies across the globe amid QE have "clearly supported a strong rebound in fixed income markets." This should not be a surprise: as Martin calculated, there is now some $51 trillion at risk should rates vol spike, not to mention countless housing bubbles that have been created since the financial crisis where the bulk of middle class wealth h

Authored by Simon Black via SovereignMan.com,

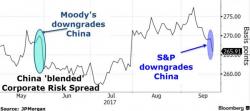

First it was Pets.com, and all the unbelievably stupid Internet businesses in the 1990s.

Investors were so eager to buy dot-com stocks, all you had to do was put an “e” in front of your business or product and you’d immediately be worth millions.

It didn’t matter that most of these companies didn’t make any money. Investors kept buying.

Authored by Economic Prism's MN Gordon via Acting-Man.com,

Past the Point of No Return

Adventures in depravity are nearly always confronted with the unpleasant reality that stopping the degeneracy is much more difficult than starting it. This realization, and the unsettling feeling that comes with it, usually surfaces just after passing the point of no return. That’s when the cucumber has pickled over and the prospect of turning back is no longer an option.