Forget The Hype: Public Infrastructure Generates Waste, Fraud And Abuse

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Authored by Simon Black via SovereignMan.com,

On Tuesday afternoon, Jamie Dimon, the CEO of banking giant JP Morgan, let loose on Bitcoin.

He was speaking at the Barclays Financial Services conference, and when asked whether his bank employs any Bitcoin traders, he responded-

“If we had a trader who traded Bitcoin, I’d fire them in a second,” calling any trader who deals in the cryptocurrency “stupid”.

He went on to say that Bitcoin is a “fraud” and “won’t end well”.

Authored by Dave Forest via OilPrice.com,

Big disappointment in the global natural gas industry this week, with majors Total and Eni coming up largely dry in a much-anticipated well offshore Cyprus.

But elsewhere things are turning extremely bullish for natgas. With one of the world’s fastest-emerging energy consumers scrambling to get all the supply it can.

India.

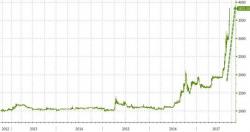

Unhappy about the 30% decline in Bitcoin (after it has rallied 545% year-to-date), then how about this mystery bubble stock?

It has the same attractive vertical chart pattern...

It's now more expensive than Bitcoin - so that must be good...

But you better hurry, because it seems that as Bitcoin collapses, so 'investors' are rushing into this mystery bubble stock...

What is this mystery bubble stock? Simple, see here.

Having surged earlier in the day following an unexpectedly hawkish BOE statement, moments ago GBPUSD jumped to fresh session highs after BOE Governor Mark Carney said the pound's decline is boosting prices, and added that he’s among the majority of MPC with view that policy may need to be tightened in coming months. Some other comments: