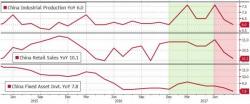

Chinese Economic Data Misses Across The Board As Credit Impulse Slump Kicks In

The brief encounter with a 'recovery' that China's economic data enjoyed in the first half of 2017 has evaporated as the reality of a collapsing credit impulse strikes across the board. Retail Sales, Fixed Asset Investment, and Industrial Production all missed expectations and slowed dramatically.

Tonight's bid China data dump to ignore includes: