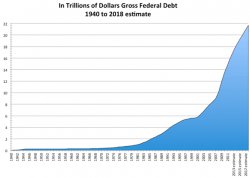

"Worst Possible Choice For US Economy" - Peter Schiff Slams Plan To Repeal Debt-Ceiling

Authored by Peter Schiff via Euro Pacific Capital,

Authored by Peter Schiff via Euro Pacific Capital,

After Facebook CEO Mark Zuckerberg earlier this week confirmed allegations that the company had sold at least $100,000 of ads to a Russia-backed troll farm – igniting a firestorm of liberal sanctimony as pundits like Rachel Maddow proclaimed that they had finally found the “smoking gun” proving that Russians had swayed the election in President Trump’s favor – researchers at the University of Iowa have pulled back the curtain on the seedy underbelly of Facebook's illicit influence-peddling economy.

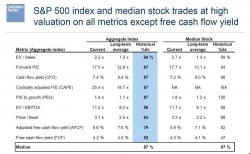

Over the years, the clients of Goldman Sachs have periodically found themselves on the verge of panic.

Authored by Raul Ilargi Meijer via The Automatic Earth blog,

A number of people have argued over the past few days that Hurricane Harvey will NOT boost the US housing market. As if any such argument would or should be required. Hurricane Irma will not provide any such boost either. News about the ‘resurrection’ of New Orleans post-Katrina has pretty much dried up, but we know scores of people there never returned, in most cases because they couldn’t afford to.

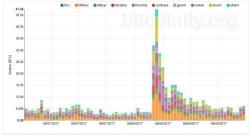

One day after Bitcoin crashed on a massive surge in volume, following a report in China's Caixin website that Chinese authorities plan to shut local Bitcoin exchanges....

... there is still far more confusion than clarity about what is really going on in China: so far there has been no official statement from either the PBOC or China's financial regulator, confirming or denying the report, which spooked millions of Chinese bitcoin (and ethereum and litecoin) holders into dumping their digital currencies. As a reminder, this is the gist of the Caixin report: