Toronto Home Price Bubble Bursts Into Bear Market

Authored by Wolf Richter via WolfStreet.com,

With surprise rate hike, Bank of Canada turns against housing market...

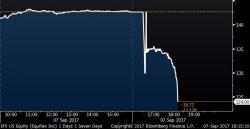

Home sales in the Greater Toronto Area, the largest housing market in Canada, plunged 34.8% in August compared to a year ago, to 6,357 homes, with sales of detached homes and semi-detached homes getting eviscerated:

Sales by type: