Consumer Credit & The American Conundrum

Authored by Lance Roberts via RealInvestmentAdvice.com,

Authored by Lance Roberts via RealInvestmentAdvice.com,

Last night's first glimpse of Harvey's impact on energy confirmed a sizable crude build but only modest gasoline draw. WTI/RBOB prices slid into the DOE print and extended losses (after a quick kneejerk higher) following a bigger than expected crude build (+4.58mm vs +4mm exp). Gasoline and Distilates saw bigger draws than API reported but it was the collapse in Lower 48 crude production that stood out with most of Texas offline.

API

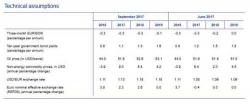

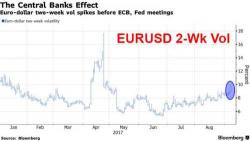

Having concluded that Draghi's speech was on the margin dovish, not least of all due to Draghi's parting shot at Euro bulls, saying that "nothing will derail ECB's will to deliver inflation", a refreshed version of "Whatever it takes", the EURUSD has since slumped from session highs, and was back under 1.20, in fact filling the entire post-Draghi gap, driven in part by the release of the ECB's currency forecasts, which are far below the spot rate going all the way to 2019.

This is what the ECB now forecasts:

The market bubble has become so massive that even Wall Street is nervous.

To be clear, investment banks do best when stocks are in a bull market. And they love bubbles because it means more M&A, IPOs, dead offerings, stock issuance and other deals from which they derive their revenues.

So for Wall Street CEOs to openly start warning that the market is in a bubble… they have to be really REALLY nervous about what they’re seeing... and know that a stock market crash is coming

On that note this week, not one but TWO major bank CEOs warned about the markets.

S&P futures are flat, still spooked by the WSJ's report that Gary Cohn will not be the next Fed chair, while both European stocks and Asian shares gain in a overnight session on edge in which everyone is looking forward to today's main risk event: the ECB meeting and Draghi press conference due in under two hours. The dollar continued to weaken against most G-10 peers as tensions over North Korea, concerns over Stan Fischer's resignation and the increasingly cloudy Fed outlook outweighed positive sentiment from the US debt ceiling extension.