The Canadian Cointoss: Bank Of Canada Monetary Policy Decision Preview

From RanSquawk

From RanSquawk

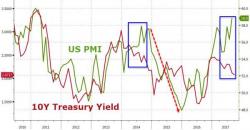

US survey-based PMIs have surged to their highest levels since April 2011 in the last few months, seemingly signifying to all that the US economy is chugging along nicely and escape-velocity-driven nirvana is right around the corner. There's just one thing... the bond market is calling bullshit!

The last time this kind of decoupling happened was in 2014... and that did not end well for PMIs and the economy, which slumped to catch down to the leading indications of bonds.

The head of Germany’s largest commercial bank warned of the fallout from cheap money, cautioning against using the strong euro as a justification for printing more.

Bloomberg reports that the Deutsche Bank Chief Executive Officer John Cryan called for an end to the era of cheap money in Europe, saying that the prolonged period of rock-bottom interest rates is starting to inflate asset bubbles and putting the bank at a disadvantage to U.S. rivals.

The US trade deficit widened in July, growing by 0.3% from a downward revised $43.5 billion to $43.7 billion, and beating expectations of $44.7 billion, as exports decreased more than imports. The goods deficit decreased less than $0.1 billion in July to $65.3 billion. The services surplus decreased $0.2 billion in July to $21.6 billion.

Breaking down the components, first exports:

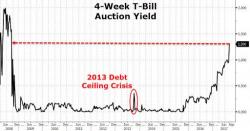

Yesterday we highlighted the turmoil in the T-Bill market, when the sale of $20 billion in 4 week paper priced at a high yield of 1.30%, a whopping 7bps tail, and the highest yield since September 2008.