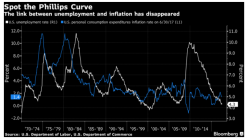

Fed Study Confirms Phillips Curve Is Useless: Admitting The Bloody Obvious

Authored by Mike Shedlock via MishTalk.com,

The Phillips Curve, an economic model developed by A. W. Phillips purports that inflation and unemployment have a stable and inverse relationship.

This has been a fundamental guiding economic theory used by the Fed for decades to set interest rates.

A new Fed Study shows the Phillips Curve Doesn’t Work.