Are You Prepared For These Potentially Disruptive Economic Storms?

Authored by Frank Holmes via StockBoardAsset.com,

Summary

- Are government inflation numbers more “fake news”?

- A falling dollar is good for U.S. trade.

- Are you ready for a big fight?

Authored by Frank Holmes via StockBoardAsset.com,

Summary

Sometimes you just have to laugh...

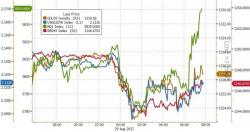

The dollar is down, gold is up, Treasury yields are tumbling, and bitcoin is higher...Spot the odd one out

So why are stocks unchanged?

Here's why...

The prices of Bitcoin has exploded overnight, surging over 6% to a new record high above $4600 as demand from South Korea and Japan spurred more safe haven buying as gold and Treasury bond prices rose following North Korea's most provocative missile launch yet.

Heavy volume taking Bitcoin higher...

The cryptocurrency landscape is a little more mixed but Ether is gaining...

This mornig's rally has pushed the cryptocurrency market cap over $160 billion for the first time.

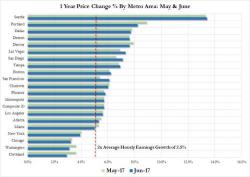

According to the latest BLS data, average hourly wages for all US workers rose 2.5% relative to the previous year, well below the Fed's "target" of 3.5-4.5%, as countless economists are unable to explain how 4.3% unemployment, and "no slack" in the economy fails to boost wage growth. Another problem with tepid wage growth, in addition to crush the Fed's credibility, is that it keeps a lid on how much general price levels can rise by.

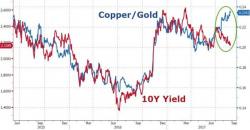

While Jeff Gundlach's favorite chart continues to diverge, as Treasury yields tumble (10Y at 2.08 lows today) and despite gold's surge, copper's keeping up...

Knowledge Leaders Capital blog's Steven Vannelli takes a look at how to value gold and how to leverage the gold breakout into fixed income markets.

Today gold is trading over $1,325, the highest since November 9, 2016.

The breakdown in the USD Index last week was a good signal telegraphing the short-term breakout in gold.