The 5 Steps To World Domination

Authored by Charles Hugh Smith via OfTwoMinds blog,

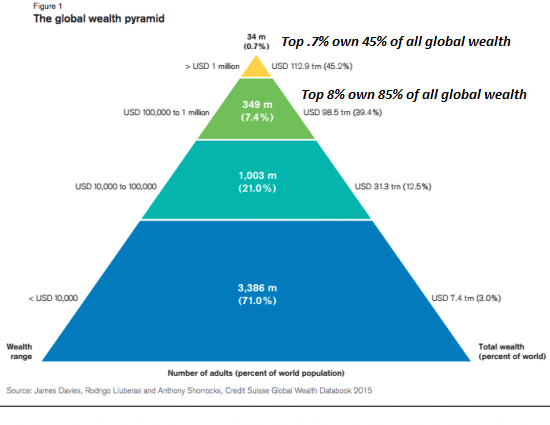

You don't need an army to achieve World Domination; all you need is enough cheap credit to buy up everything that generates the highest value and/or income.

World Domination--it has a nice ring, doesn't it? Here's how to achieve it in 5 steps: