"Pray For A Bear Market": One Bank's "Paradoxical" Advice To Active Managers

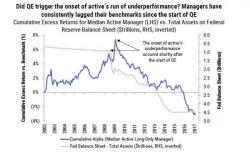

Back in April, we showed that according to a Goldman Sachs report, the current run of chronic active manager underperformance began shortly after the launch of QE in 2009.

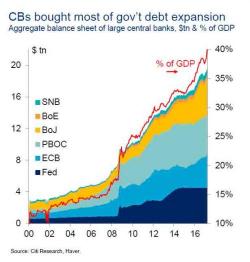

As discussed earlier today by Matt King in his report on "one-way" markets resulting from QE and ETFs, this period has been marked by "stubbornly low volatility and dispersion", something Goldman first observed four months ago:

Which brings us to what we concluded back in April in "Dear Hedge Funds: This Is Who Is Responsible For Your Deplorable Returns", namely that: