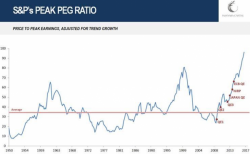

"Peak PEG" - The S&P Has Never, Ever Been This Expensive

Authored by Francesco Filia via Fasanara Capital,

Measuring the Equity Bubble

Authored by Francesco Filia via Fasanara Capital,

Measuring the Equity Bubble

Terrible housing data for the second day in a row, debt ceiling fears surging in bill markets, chaos in the energy complex as Hurricane Harvey nears landfall, more McConnell-Trump turmoil... and while stocks were lower, only Trannies really dropped... The market said...

Authored by Mac Slavo via SHTFplan.com,

On Wednesday there were a lot of Trump fans who were celebrating the latest progress in the stock market. For the first time in over 100 years, the DOW gained 4,000 points over the course of 200 working days. That’s 4,000 points since Trump was elected, so it’s easy to draw a connection between the stock market’s dizzying new heights and Trump’s ascent to the White House.

Here comes even more of that deflation the Fed hates so much.

Walmart stock is getting whacked, as is the broader grocer sector, after Amazon announced moments ago that the acquisition of Whole Foods will close on Monday, and that in keeping with the company's tradition of stealing market by underpricing its competition, it will cut prices at Whole Foods once the deal closes.

A lot has happened since The White House's last on-camera press briefing - from Charlottesville to CEO-denouncements and Bannon's departure, and from Afghanistan to tax reform and GOP infighting. Sarah Huckabee-Sanders has her hands full - grab your popcorn...

Live Feed: