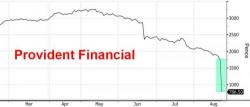

"Clearly Awful News": UK Subprime Lender Provident Crashes Most On Record, CEO Quits

UK subprime lender Provident Financial Plc crashed the most on record, its stock plunging over 73%, on what analysts called a "quadruple whammy": a profit warning forecasting a full-year loss, scrapping its dividend, a regulator probe into its Vanquis Bank unit, and the departure of CEO, the aptly named, Peter Crook. “This is without doubt a disaster,” said Shore Capital's Gary Greenwood. “Future profit performance will depend on management’s ability to rescue the situation, which is highly uncertain. We expect that further heads will roll.”