Peter Schiff On Trump 'Owning The Stock Market Bubble': "The Fed Now Has Their Fall Guy"

Via The Ron Paul Liberty Report,

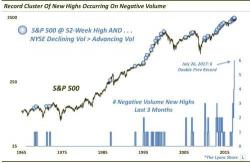

Let's start at the beginning. Bubbles and Busts are both created by The Federal Reserve.

Presidents are merely along for the ride. They like to credit themselves for the bubbles, and then look for scapegoats, usually the (non-existent) free market during the busts.

But it is The Fed that creates them both.