Steen Jakobsen On The Next 30 Years: "Everything Is Deflationary"

Authored by Mike Shedlock via MishTalk.com,

Steen Jakobsen, Saxo Bank chief economist and CIO just pinged me with a PowerPoint presentation on the preceding and next 30 years.

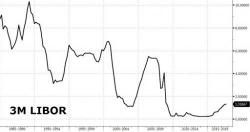

He commented “I somehow to my own surprise came to one single trend I believe in: everything is deflationary. Enjoy the “funny pictures” and the outlook.”

30 Years Ago

Current and Foreward Trends

Mish Comments