The Death Cross Of Central Bank Credibility

With no expectations of a rate-hike this week, and traders rapidly giving up on The Fed's dream of a steadily higher rate trajectory, a funny thing happened in the markets...

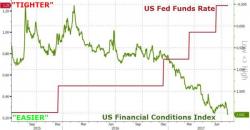

In the eyes of The Fed, their monetary policy has not been this 'tight' since October 2008.

However, in the eyes of the market, financial conditions just hit their easiest level in history (easier than the September 2005 previous record easiness level).