Business Customers Are Tired Of Being Bilked Of Billions; Demand Rate Increases On Their Bank Deposits

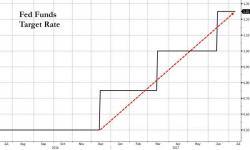

As we're all well aware by now, once Trump was elected on November 8th the Fed suddenly decided it was no longer necessary to prop up asset prices in the United States with artificially low interest rates. As such, they've embarked on their first rate-hiking spree since the last one ended just over a decade ago.