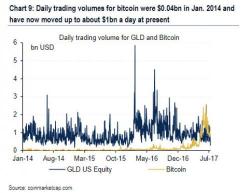

Daily Trading Volume In Bitcoin Surpasses GLD

Several weeks after Goldman's chief technician started covering bitcoin, overnight Bank of America has released what some may call an "initiating coverage" report on bitcoin which notes that while the cryptocurrency remains very volatile and risky, bitcoin has experienced a spectacular surge in liquidity in the last six months. However, BofA remains stumped when it comes to making any official forecasts BofA's commodity strategist Francisco Blanch writes that bitcoin is uncorrelated to any financial asset, "so there is no way to explain let alone predict returns."