3-Month Treasury-Bill Auction Prices At Highest Yield Since Lehman On Debt-Ceiling Concerns

It seems Morgan Stanely was right when they said "the debt ceiling worries us most," as today's 3-month T-Bill auction surprised the market with its highest yield since the fall of 2008, as investors continue to price concerns that the U.S. government will exhaust its borrowing authority around mid-October.

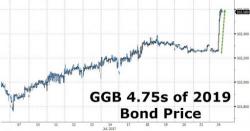

As SMRA details: