The FX Week Ahead: The Dollar Crashes Again, Can The Fed Revive The USD At Wednesday's FOMC?

Submitted by Rajan Dhall from fxdaily.co.uk

FX Week Ahead - The greenback crashes again! Could Fed chair revive the USD at Wednesday's FOMC.

Submitted by Rajan Dhall from fxdaily.co.uk

FX Week Ahead - The greenback crashes again! Could Fed chair revive the USD at Wednesday's FOMC.

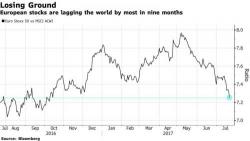

In a mixed session, which has seen Asian stocks ex-Japan broadly higher, the European Stoxx 600 index dropped as much as 0.6% after data Markit PMI data signalled euro-area economy grew in July at its slowest pace in six months while carmakers extended declines on continued concern about antitrust collusion in the industry. Germany’s DAX Index was hardest-hit euro-area benchmark, down as much as 0.8%. Autos continued to be the worst-performing sector on the Stoxx Europe 600 after EU and German regulators said they are studying possible collusion among German automakers.

Authored by Mike Shedlock via MishTalk.com,

On June 14, Reuters reported Munich, Home to BMW, Considers Diesel Ban to Tackle Pollution.

Today, with strong overtones of regulators hopping in bed with industries they are supposed to regulate, EU’s Car Regulator Warns Against Diesel Ban in Cities.

Munich, home to carmaker BMW, has become the latest German city to consider banning some diesel vehicles amid “shocking” nitrogen oxide emissions in the Bavarian capital.

Something needs to be said. We are against the existence of irredeemable paper currency, central banking and central planning, cronyism, socialized losses and privatized gains, counterfeit credit, wealth transfers and bailouts, and welfare both corporate and personal.

According to RealVision, he’s one of the greatest investors you’ve never heard of. According to us, he ran what was (formerly) the world's most bearish hedge fund, although at the end of 2016, after suffering substantial losses, he capitulated and went flat, after closing much of his short book.