Record Apartment Building-Boom Meets Reality: First CRE Decline Since The Great Recession

By Wolf Richter of WolfStreet

Even the Fed put commercial real estate on its financial-stability worry list.

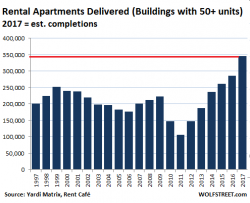

No, the crane counters were not wrong. In 2017, the ongoing apartment building-boom in the US will set a new record: 346,000 new rental apartments in buildings with 50+ units are expected to hit the market.