"Swipe Right To Buy" - Bankers Swoop On Tinder Amid Trading Lull

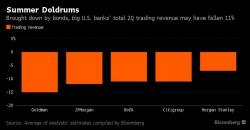

America’s largest banks and their shareholders were quick to celebrate a recovery in trading revenues over the past year. But they may have spoken too soon.

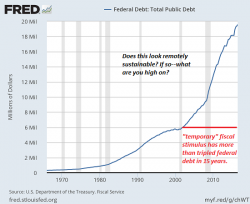

Wall Street vets know they can’t fight the Fed – especially with the ostensibly “data-dependent” central bank committing to returning the Fed funds rate to 3% over the next two years. But with the arrival of the summer doldrums ushering in low trading volumes across markets, traders are acknowledging that they can’t fight the seasons, either.