High Yield IED

Submitted by Michael Lebowitz of 720 Global

“What we’re seeing is an increase in the evolutionary pace of IED (improvised explosive device) design. It’s increasing at a pace we previously haven’t seen.”

- Ben Venzke

Submitted by Michael Lebowitz of 720 Global

“What we’re seeing is an increase in the evolutionary pace of IED (improvised explosive device) design. It’s increasing at a pace we previously haven’t seen.”

- Ben Venzke

One month after the CBO scored the now defunct Senate healthcare bill, forecasting it would increase the number of uninsured by 22 million while cutting the budget deficit by $321 billion over the next ten years, moments ago the CBO released its latest score of what a straight repeal of Obamacare would look like. In short, doing away with the Affordable Care Act, would increase the number of uninsured by 32 million by 2026, while reducing the budget deficit by $473 billion in the CBO's view.

Nikkei Asian Review's William Pesek wonders if the BoJ is about to shock the markets again as pressure is mounting on Kuroda to save Abenomics...

Masaaki Shirakawa could be forgiven for some Schadenfreude. In March 2013, the then-Bank of Japan governor was shown the door by a prime minister who felt he had not eased monetary policy enough. Now his successor is starting to worry about his own job security.

Authored by Ben Hunt via Epsilon Theory blog,

What do socialism and modern monetary policy have in common? Magical thinking. For both, it’s true on the giddy years up, and it’s true on the sad years down.

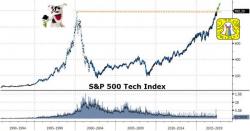

"Buy and Hold"... for 17 years to turn a profit.

After a nine-day winning streak the S&P 500 Technology Sector has finaly surpassed its dotcom bubble peak. Today's 992.29 close is above the previous record of 988.49 on March 27 2000.